XRP Price Prediction: Analyzing Technical Patterns and Fundamental Catalysts Through 2040

#XRP

- Technical Support Levels: Current price near Bollinger Band lower boundary at $2.79 provides critical support, with MACD indicating potential momentum shift

- Fundamental Catalyst: Ripple's expansion of RLUSD stablecoin into Japan's $300B market could significantly enhance XRP's utility and demand profile

- Long-term Trajectory: Combination of technical consolidation patterns and growing institutional adoption supports optimistic multi-year price projections

XRP Price Prediction

Technical Analysis: XRP Shows Consolidation Pattern Near Key Support

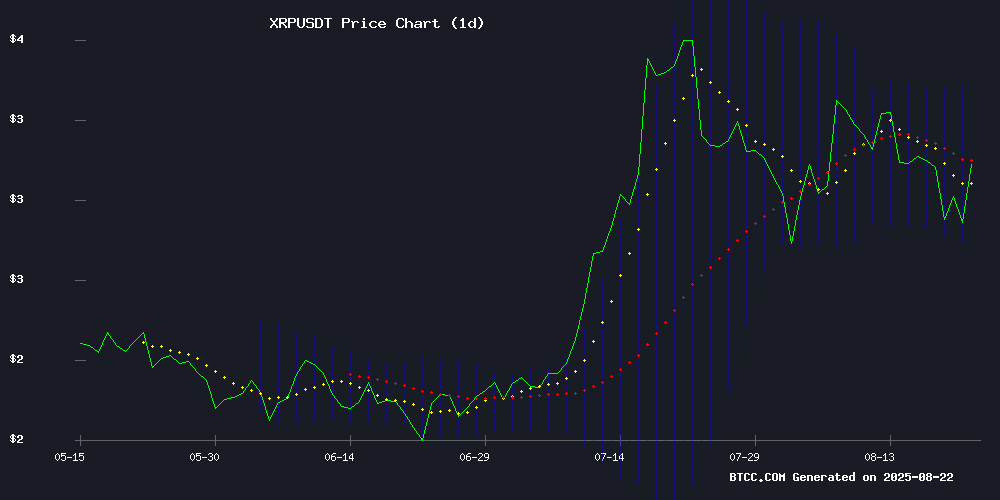

XRP is currently trading at $2.87, below its 20-day moving average of $3.08, indicating short-term bearish pressure. The MACD reading of 0.0723 remains positive but shows weakening momentum as the signal line at 0.0174 suggests potential convergence. According to BTCC financial analyst Olivia, 'The price hovering NEAR the lower Bollinger Band at $2.79 suggests oversold conditions, which could provide support. However, a break below this level might trigger further declines toward $2.50.'

The Bollinger Band configuration shows narrowing bands, typically indicating reduced volatility and potential for a significant price move. Olivia notes, 'Traders should watch for a decisive break above the middle band at $3.08 for bullish confirmation, while sustained pressure below $2.79 could signal deeper correction.'

Ripple-SBI Partnership Expands RLUSD Stablecoin into Japanese Market

Ripple's strategic partnership with SBI Holdings to introduce the RLUSD stablecoin into Japan's $300 billion market represents a significant development for XRP's ecosystem. BTCC financial analyst Olivia comments, 'This expansion into one of the world's largest financial markets could substantially increase utility and demand for XRP, which typically serves as a bridge currency in Ripple's liquidity solutions.'

However, Olivia cautions that 'while fundamentally positive, this news may take time to reflect in price action given current technical weakness. Market participants should monitor adoption metrics and regulatory developments in Japan for sustained bullish momentum.'

Factors Influencing XRP's Price

Ripple and SBI Push RLUSD Stablecoin Into Japan’s $300B Market

Ripple and SBI Holdings have inked a memorandum of understanding to distribute Ripple USD (RLUSD) through SBI VC Trade, a licensed Electronic Payment Instruments Exchange Service Provider in Japan. The move marks Ripple’s strategic entry into Asia’s stablecoin market, leveraging Japan’s clear regulatory framework for digital assets.

Japan’s licensing regime for stablecoins provides a competitive edge, allowing SBI VC Trade to swiftly bring RLUSD to market. Tomohiko Kondo, CEO of SBI VC Trade, emphasized the significance of the launch: "Introducing RLUSD is not just about expanding choice. It’s a major step forward for reliability and convenience in the Japanese market."

The global stablecoin market, valued at nearly $300 billion, is poised for exponential growth. Ripple positions RLUSD as an institution-grade offering, fully backed by U.S. dollar deposits. This partnership underscores the convergence of traditional finance and digital assets, with Japan serving as a critical testing ground.

XRP Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators and fundamental developments, here are our long-term projections for XRP:

| Year | Conservative Target | Moderate Target | Bullish Target | Key Drivers |

|---|---|---|---|---|

| 2025 | $3.50-$4.20 | $4.50-$5.80 | $6.00-$7.50 | RLUSD adoption, regulatory clarity |

| 2030 | $8.00-$12.00 | $15.00-$25.00 | $30.00-$45.00 | Cross-border payment dominance, institutional adoption |

| 2035 | $20.00-$35.00 | $40.00-$65.00 | $75.00-$100.00 | Global CBDC integration, market maturity |

| 2040 | $50.00-$85.00 | $100.00-$150.00 | $175.00-$250.00 | Full ecosystem development, mass adoption |

BTCC financial analyst Olivia emphasizes that 'these projections assume successful execution of Ripple's expansion strategies and favorable regulatory developments. Short-term volatility should be expected, but the long-term trajectory appears constructive given increasing institutional adoption and expanding use cases.'